As a trader, the supreme target is always to take full advantage of returns on assets when reducing deficits. Attaining this calls for forex traders to experience a comprehensive comprehension of the financial markets and noise expense strategies. One strategy that lots of traders forget about is perfecting the skill of take profit strategies. In this article, we’ll take a closer look at what take profit is, the many take profit tactics, and ways to use them to enhance your results.

Precisely what is Take Profit?

futures trading review is definitely an instructions which is established by way of a trader that directs their brokerage to seal a trade every time a predetermined selling price levels has been attained. It is actually a trader’s way of locking in income. Each time a trader collections a take profit stage, they can be essentially setting the retail price degree from which they’d prefer to get out of a industry and take their revenue. Take profit can be a chance managing strategy that is beneficial in unstable market segments where rates can fluctuate rapidly.

Various Take Profit Strategies:

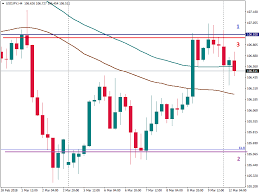

There are different methods of employing take profit techniques, like reasonable worth, technical evaluation, and simple assessment. One method to use specialized analysis would be to set up take profit ranges at critical assistance and level of resistance degrees. This is achieved by examining the current market price craze and figuring out crucial amounts of support and opposition. For instance, if your trader gets into a buy and sell at $100 and identifies a amount of resistance stage at $110, they might establish a take profit levels at $109 to prevent the danger of the retail price losing underneath the opposition level.

Another technique is to use a trailing end-loss get like a take profit degree. Trailing cease-loss requests aid to lock in profits by changing the quit decrease stage as costs transfer the trader’s prefer. This means that in case the price techniques inside the trader’s prefer, the end loss is altered to follow along with the purchase price to ensure that when the cost falls, the buy and sell will likely be closed with the end-decrease degree.

Employing Fundamental Examination to create Take Profits:

Basic examination is yet another approach that forex traders can make use of to put take profit degrees. This type of analysis requires the examination of any company’s fiscal and monetary position. Forex traders are able to use essential assessment to ascertain a company’s fair value and set take profit degrees based on that benefit. For instance, if a trader thinks that the clients are undervalued, they might set a take profit stage that is more than the present market price.

Simply speaking:

Being a trader, perfecting take profit methods is essential in optimizing results. Dealers should carefully examine the industry trend, recognize support and resistance amounts, and make use of technological and fundamental evaluation to put take profit amounts. You should ensure that you have a great idea of the current market and the various take profit strategies readily available well before applying them. By learning these techniques, you’ll not merely have the capacity to improve your earnings but additionally reduce your failures.